As an Amazon seller, you’re used to seeing orders roll in, but have you ever noticed that not all payments arrive on the same schedule? The difference often comes down to one key distinction: whether you’ve received a standard order or an invoiced order. Understanding this difference is essential for managing your cash flow, forecasting your revenue, and tapping into a lucrative B2B market.

Let’s break down exactly what sets these order types apart and what it means for your business strategy.

1. Differentiate Your Core Order Types

The primary distinction between a standard and an invoiced order is the timing and method of payment, which depend on the customer type.

A Standard Order is the classic Amazon transaction you’re most familiar with. It’s placed by an individual consumer who pays for the item instantly at checkout. They use a credit card, debit card, or another immediate payment method. For you, the seller, this is straightforward; the funds are secured immediately and transferred to you per your regular payment schedule after the order ships.

An Invoiced Order, on the other hand, comes from a qualified Amazon Business customer. These buyers use a feature called “Pay by Invoice,” which allows them to purchase products now and pay for them later, similar to a traditional purchase order system. This means you won’t receive your payment immediately upon shipment.

2. Understand the “Pay by Invoice” Process

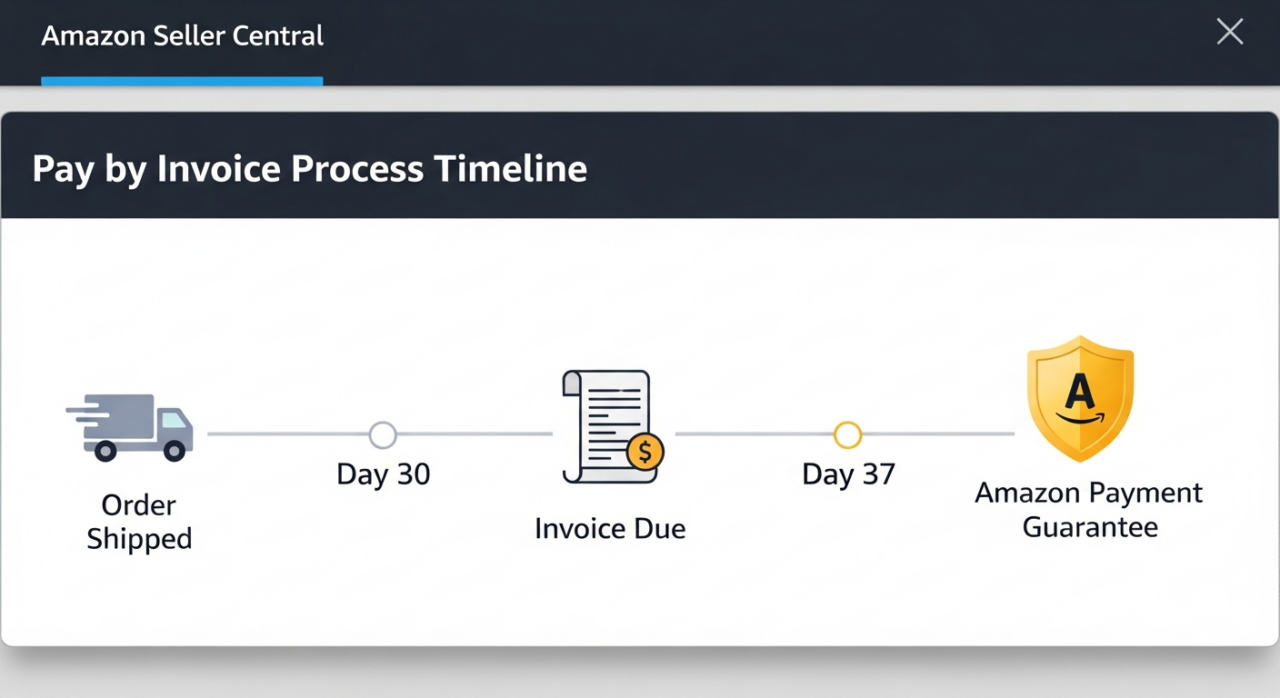

When you receive an invoiced order, the payment timeline is extended. The most common term for these orders is “Net 30,” meaning the business customer has 30 days from the invoice date to pay the invoice.

This might sound risky, but Amazon has a system in place to protect sellers. Amazon guarantees payment for these orders. If the business customer hasn’t paid their invoice by the due date, Amazon will credit your seller account on the 7th day after the due date. This safety net ensures you always get paid for the products you ship.

3. Know Your High-Value Business Customer

So, who are these customers placing invoiced orders? They aren’t just any shoppers. To use the “Pay by Invoice” feature, a customer must have an Amazon Business account and be approved by Amazon, which includes a credit assessment. It’s an invite-only feature reserved for qualified businesses.

Many of these customers are enrolled in Business Prime, a membership program that provides additional benefits, including extended payment terms. Depending on their membership tier, these buyers can get longer payment windows:

- Net 30: Standard for eligible Amazon Business accounts.

- Net 45: Available for Small and Medium Business Prime members.

- Net 60: Offered to top-tier Enterprise Business Prime members.

These buyers are often larger organizations, ranging from small businesses to enterprise-level corporations, making substantial, recurring purchases. While you wait a bit longer for payment, you gain access to a customer base that can provide significant, long-term value.

4. Strategically Manage Your Invoiced Order Cash Flow

The delayed payment schedule of invoiced orders can be a challenge for sellers who rely on a steady, immediate cash flow. Fortunately, Amazon provides an option to get your money faster.

If you don’t want to wait for the invoice due date, you can be paid immediately after confirming the shipment. To do this, you pay a 1.5% processing charge on the order total. This allows you to convert an invoiced order’s payment timeline to a standard order timeline, giving you greater control over your finances. You must weigh the 1.5% fee against the benefit of having immediate access to your capital.

By understanding these distinct order types, you can better forecast revenue, make informed cash-flow decisions, and strategically target the B2B market on Amazon. At EHP Consulting Group, we specialize in helping sellers navigate complexities like these. Optimizing for B2B customers requires a unique strategy, and our full range of services is designed to help you succeed. If you’re looking to improve your visibility to these high-value buyers, start with a free listing audit. For any questions, please contact us today..

“`

Need Help Growing Your Sales?

We are here to help you scale.

Written By: Janine Alaban

Email: [email protected]

Website: http://www.ehpconsultinggroup.com

Number: 925-293-3313

Date Written: December 22, 2025