Why Accurate Tax Information Is Critical for Walmart Sellers

If you’re selling on Walmart Marketplace, keeping your tax information up to date is not just a good practice — it’s essential for compliance, receiving disbursements, and avoiding account suspensions.

Incorrect or outdated details can delay your payouts or even pause your listings.

At EHP Consulting Group, we help Walmart Sellers avoid compliance pitfalls by ensuring their account settings, including tax information, are optimized and error-free.

How To Update Tax Information in Walmart Seller Center (Step-by-Step)

Follow these steps to quickly update your tax settings within Walmart Seller Center:

🔹 Step 1: Log in to Your Walmart Seller Center

Go to seller.walmart.com and log in with your credentials.

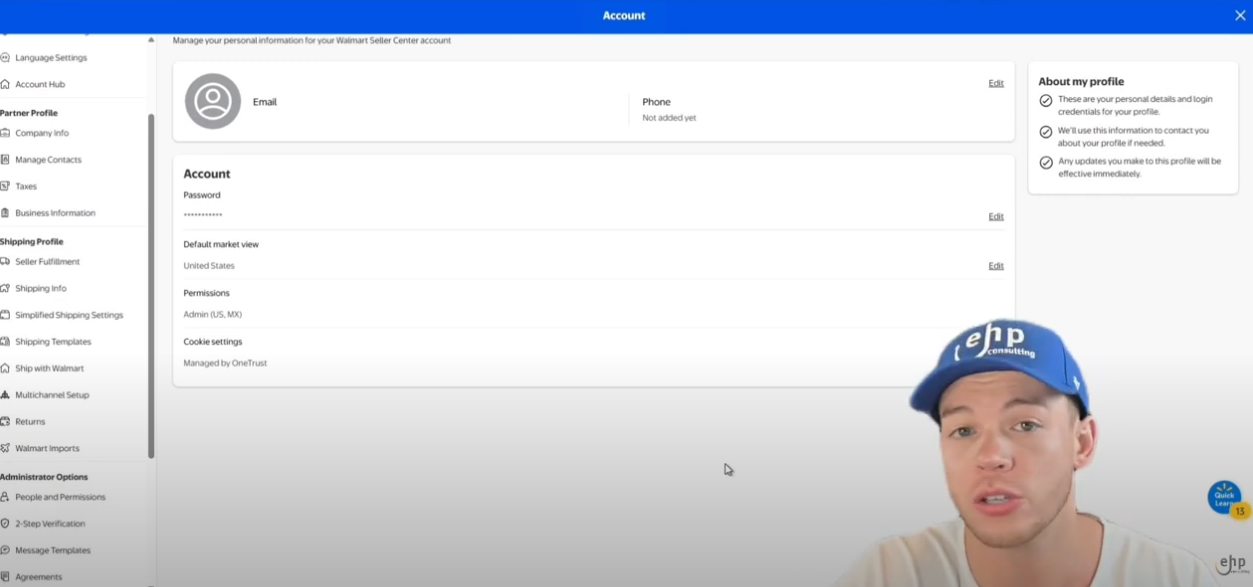

🔹 Step 2: Navigate to “Settings”

On the top right corner of your dashboard, click the gear icon ⚙️.

🔹 Step 3: Go to “Business Information”

On the left menu, scroll down to find “Business Information.” Edit Business Detail.

🔹 Step 4: Enter Updated Information

You will need to input the following depending on your seller type:

- Business Name / EIN (for registered companies)

- SSN (if you’re an individual seller)

- Business Address

- W9 / W8-BEN Form info (U.S. or International)

🔹 Step 5: Save and Confirm

Once you’ve made changes, double-check all entries for accuracy. Then click Save & Continue.

Walmart may take 24–48 hours to verify your tax profile changes.

🎥 Need a visual guide?

📺 Watch our full YouTube tutorial here

Pro Tips from Walmart Experts

- Always match your EIN or SSN with IRS records to avoid errors

- Use official forms like the W-9 directly from the IRS website

- For international sellers, submit the correct W-8 form variant

Avoid Mistakes That Can Trigger Account Reviews

Tax mismatches are among the leading reasons for account holds or disbursement delays on Walmart.

Our Walmart experts at EHP Consulting help sellers review compliance settings across all areas, including:

- Payment methods

- Tax documentation

- Business verification

- Product listing legalities

Get Help from a Walmart Consultant

Don’t leave your account vulnerable to small mistakes. Whether it’s taxes, listings, or counterfeit threats, a Walmart Consultant from EHP Consulting can keep your business protected and growing.

Keeping your tax information accurate on Walmart Seller Center isn’t just a checklist item — it’s essential for your business health.

Let EHP Consulting guide you every step of the way — from tax updates to Walmart advertising and product compliance.

Written By: Ahzel P. Miral

Email: [email protected]

Website: http://www.ehpconsultinggroup.com

Number: 925-293-3313

Date Written: August 26, 2025