Are you considering entering the realm of e-commerce and dipping your toes into Amazon selling? You might wonder whether an LLC is a prerequisite.

In short, you don’t require an LLC to kickstart your Amazon sales journey. Operating as a sole proprietor under your name suffices initially.

However, pondering the transition to an LLC becomes pertinent as you delve deeper into the Amazon business landscape. What sets an LLC apart from a sole proprietorship? What advantages come with running an LLC?

Disclaimer: While we at EHP Consulting Group can offer insights, we aren’t legal or financial experts. We recommend consulting with a qualified professional for tailored advice on structuring your business.

What is a Sole Proprietorship?

In business ownership, a sole proprietorship is the simplest form, operated by a single individual. Transitioning into a sole proprietorship is as straightforward as commencing sales activities, automatically marking your entry into this status. While it offers simplicity in operations, it’s crucial to note the absence of legal separation between owner and business, leaving the owner personally liable for any incurred debts or legal actions.

What is an LLC? (Limited Liability Company):

Contrasting the straightforwardness of a sole proprietorship, an LLC (Limited Liability Company) presents a distinct legal entity tailored to shield owners from liabilities and debts. Unlike its counterpart, an LLC establishes a legal divide between the owner(s) and the business, ensuring that personal assets remain safeguarded from business-related obligations. An LLC can accommodate multiple members, a feature absent in sole proprietorships.

Sole Proprietorship vs. LLC:

In dissecting the disparities between an LLC and a sole proprietorship, the paramount contrast lies in the extent of protection afforded by an LLC. An LLC is a distinct legal entity detached from its owners and offers comprehensive safeguarding. This legal structure empowers businesses to conduct operations independently, encompassing pivotal functions such as maintaining bank accounts, managing debts, pursuing legal action, and engaging in real estate transactions.

Conversely, the sole proprietorship model intertwines business and personal liabilities, rendering the owner personally accountable for any legal or financial entanglements the business encounters. However, transitioning to an LLC erects a formidable barrier, shielding personal assets from business-related liabilities. This distinction ensures that creditors cannot claim assets beyond those owned by the LLC, safeguarding cherished possessions like homes or personal savings.

While seller insurance may mitigate risks somewhat, the LLC embodies a more robust separation between business and individual, insulating personal assets from potential adversities. Even under a single-person LLC, tax obligations mirror a sole proprietorship’s, underscoring the seamless transition to enhanced protection without imposing additional tax burdens.

Key Differences:

- Legal Status: LLC operates as a separate legal entity, while sole proprietorship does not.

- Asset Protection: LLC shields personal assets from business liabilities, unlike sole proprietorship, where individual assets are at risk.

- Business Functions: LLCs can independently engage in various business activities, such as banking, borrowing, and real estate transactions, whereas sole proprietorships lack such autonomy.

- Creditor Protection: Creditors cannot pursue personal assets under an LLC, unlike sole proprietorships, where individual assets are vulnerable.

- Tax Treatment: Taxation for a single-person LLC mirrors that of a sole proprietorship, offering enhanced protection without altering tax obligations.

While the simplicity of launching a sole proprietorship may initially beckon, contemplation of long-term security beckons the necessity of transitioning to an LLC, this strategic maneuver signifies a pivotal step towards fortifying both personal and business interests against unforeseen contingencies, reinforcing the adage that proactive planning is the cornerstone of sustainable business growth.

When to Establish an LLC for Your Amazon Business:

As your Amazon enterprise flourishes and your commitment to e-commerce deepens, discerning the opportunity to establish an LLC becomes imperative. Transitioning to an LLC is pivotal in fortifying personal and business interests. Consider forming an LLC when:

- You are fully dedicated to expanding your Amazon presence and fostering business growth.

- Your monthly sales exhibit a consistent upward trajectory, signaling the evolution of your enterprise.

- Your product offerings encompass items with potential injury liabilities, such as sporting goods, health and wellness products, and supplements.

- You aspire to disentangle personal assets from business affairs, reinforcing the delineation between self and enterprise.

- Collaboration with business partners necessitates establishing a formal legal structure to delineate responsibilities and liabilities.

Seizing the opportunity to establish an LLC is paramount upon the manifestation of any of the indicators above. Contrary to misconceptions, the process of LLC formation is straightforward and yields long-term protective benefits. Harnessing the shield of an LLC safeguards against unforeseen contingencies, underscoring the proactive stance toward securing your business endeavors for sustained growth and resilience.

Do You Need A Business License To Sell On Amazon?

Entrepreneurs often wonder whether a business license is necessary for Amazon selling. Contrary to common misconception, Amazon doesn’t mandate a business license to open a seller account. However, vigilance regarding state and local regulations is paramount, as licensing requirements may vary.

Consulting with seasoned professionals such as accountants or attorneys during the foundational stages of your business is imperative to ensure compliance with pertinent regulations.

Acquiring a business license and sales tax permit is typically mandatory for sellers venturing into wholesale endeavors on Amazon. This documentation is a testament to the legitimacy of your business operations and is commonly requested by brands, wholesalers, and distributors before engaging in wholesale transactions.

Conversely, private label or retail arbitrage sellers are exempt from the necessity of a business license, provided their operations adhere to Amazon’s guidelines and regulations.

Understanding the nuanced landscape of business licensing requirements ensures regulatory compliance and fosters a conducive environment for sustainable business growth and expansion on the Amazon platform.

Do You Need A Sales Tax Permit? What is it?

Delving into sales tax permits, commonly called “resale certificates,” unveils a pivotal facet of e-commerce operations. These permits enable tax-free inventory procurement and empower sellers to collect sales tax on behalf of the state.

For Amazon sellers, the necessity of a sales tax permit typically arises, as most states mandate its possession for conducting business transactions. Take, for instance, a scenario where your business operates in New Jersey and sells products to New Jersey residents. In such cases, state regulations necessitate the collection and remittance sales tax to the state every quarter.

Moreover, Amazon FBA sellers may encounter additional sales tax obligations in states where their inventory is stored, further accentuating the importance of compliance with diverse state regulations.

While the intricacies of federal and state tax liabilities may seem daunting, seeking guidance from a qualified tax professional is paramount. By consulting with experts in the field, sellers can confidently navigate the labyrinth of tax regulations, ensuring adherence to legal mandates while fostering a conducive environment for sustainable business growth on the Amazon platform.

How do I register for a company with Amazon?

Navigating the process of registering a company for Amazon selling entails several crucial steps. The foundational cornerstone is forming a business entity, such as an LLC.

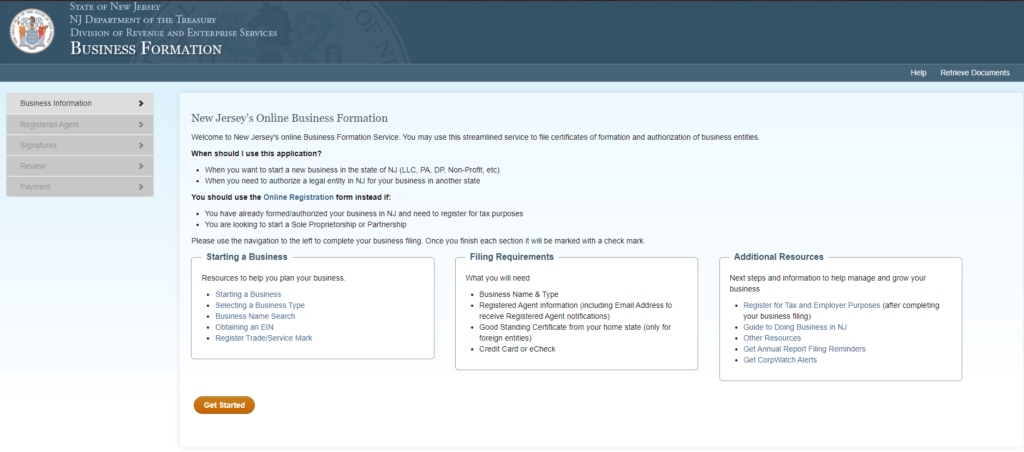

Initiating this process typically involves visiting your state’s official website, where comprehensive resources and guidelines are available for business formation. However, it’s essential to note that associated fees may vary depending on the state’s regulations and requirements.

Alternatively, engaging the services of professionals like accountants or utilizing platforms such as LegalZoom presents an expedited albeit pricier avenue for business formation.

Your state’s website is a treasure trove of information, offering invaluable insights and step-by-step guidance throughout the business formation journey. For instance, exploring the State of New Jersey’s business formation page provides a glimpse into the resources and tools available to aspiring entrepreneurs.

The Importance of an EIN for Your Business

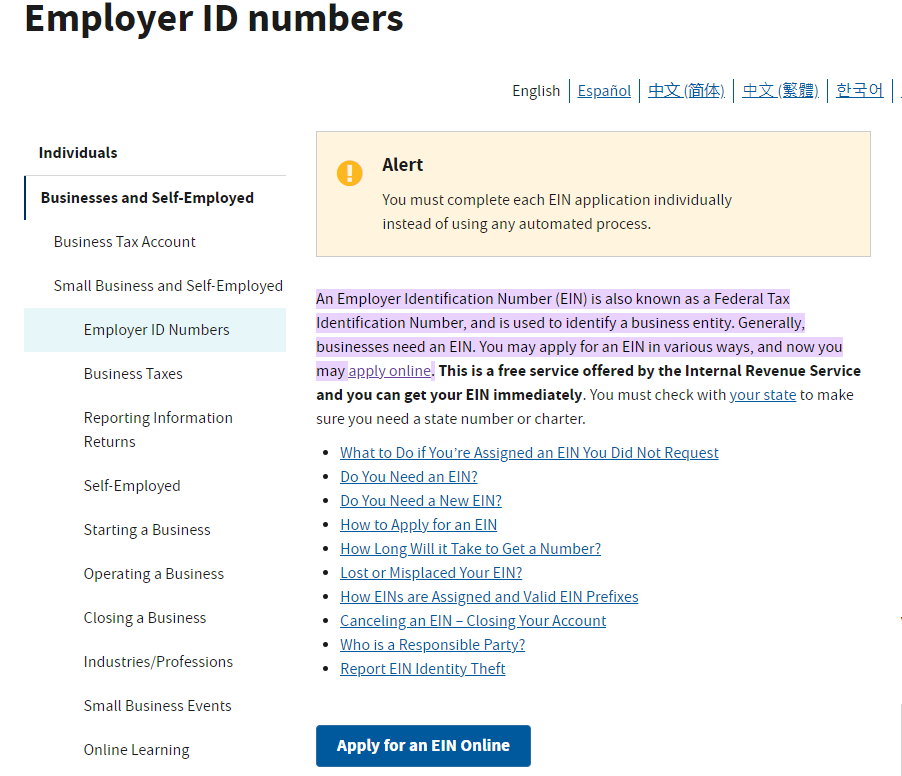

Securing an Employer Identification Number (EIN) is paramount in business formation, particularly when establishing an LLC. Analogous to a social security number for individuals, the EIN serves as the IRS’s means of identifying your business entity.

Securing an EIN is a seamless process accessible through the IRS website at no cost. It’s crucial to exercise caution and avoid falling prey to deceptive websites or services that charge fees for obtaining an EIN. Rest assured, the application process is straightforward and can be navigated independently, safeguarding your resources while ensuring compliance with regulatory requirements.

Choosing the Optimal Business Structure:

Navigating the intricacies of LLCs and sole proprietorships may appear daunting at first glance, but with diligent research, the underlying concepts become accessible. Investing time to familiarize oneself with these fundamentals is crucial, especially for entrepreneurs contemplating entry into Amazon sales.

The decision boils down to this: If you’re dipping your toes into the online selling arena and wish to gauge its viability, operating as a sole proprietor suffices. However, transitioning to an LLC offers indispensable protection and fortification for those harboring aspirations of robust growth and severe engagement with Amazon.

It’s imperative to reiterate that while we offer insights, we are not legal or financial professionals, and EHP Consulting Group does not possess the licensure to dispense official legal counsel. We strongly advise consulting with qualified professionals—attorneys or accountants—to craft a business structure tailored to your specific needs and aspirations.

We’re keen to hear from you: Have you opted for the protective shield of an LLC, or has the simplicity of a sole proprietorship proven effective for your business? Share your experiences with us! Furthermore, if you have any queries regarding LLCs or business formation, don’t hesitate to pose them in the comments section below—we’re here to assist you every step!

Need More Help? Checkout This Video For Information On Amazon Titles:

Written By: Joshua Hackett

Sponsored By: Legalzoom.com

Use LegalZoom to start your business in 3 easy steps

Email: [email protected]

Website: www.ehpconsultinggroup.com

Phone: 925-293-3313

Date Written: May 23, 2024