For years, the e-commerce world has revolved around a single giant: Amazon. It’s the default platform, the benchmark, and for many sellers, the entire universe. But in the relentless pursuit of growth, savvy entrepreneurs know that putting all your eggs in one basket is a risky strategy. The question is, where else should you look?

Increasingly, the answer is Walmart Marketplace. Once a distant second, Walmart has been aggressively investing in its third-party seller platform, creating a compelling alternative for brands and businesses. But is it just hype, or is there a real, data-driven case for diversifying? Based on verified 2025 data, the answer is clear: for many sellers, the opportunity on Walmart is no longer just an option—it’s a strategic imperative. Let’s break down the key differences where Walmart is carving out a serious competitive edge.

1. Unpacking the Fee Structure: A Lower Barrier to Profitability

For any online seller, the bottom line is king. Platform fees can eat into margins and make profitability a constant battle. This is one of the most significant areas where Walmart is actively courting sellers with a simpler, more cost-effective model.

First, Walmart has no monthly subscription fee. For sellers on Amazon’s Professional plan, that’s an immediate saving of $39.99 every month before you even make a sale. While Amazon’s Individual plan avoids this fee, its $0.99 per-item charge makes it unsuitable for businesses with any significant volume.

Second, while referral fee percentages look similar on paper (generally 6-15% on Walmart vs. 8-15% on Amazon), the real story is in the incentives. Walmart has consistently offered referral fee discounts to new sellers, sweetening the deal for those making the switch.

Perhaps the most crucial differentiator is the approach to peak season fees. During the critical Q4 holiday rush, Amazon implements a “Holiday Peak Fulfillment Fee” for FBA users, increasing costs when sellers are trying to maximize profit. In stark contrast, Walmart has demonstrated a commitment to its partners by waiving its peak season storage fees for Walmart Fulfillment Services (WFS) users for both the 2024 and 2025 holiday seasons. This isn’t just a discount; it’s a fundamental difference in philosophy that directly impacts your holiday-season profitability.

2. Navigating the Competitive Landscape: Trading a Crowded Ocean for a Growing Lake

Getting your products seen is half the battle. While Amazon boasts a colossal audience of over 2 billion monthly visitors, it comes at a cost: unprecedented competition. You are competing with approximately 1.9 million other active sellers for that attention. It’s a crowded, noisy, and often ruthless environment where gaining visibility can be incredibly expensive and difficult.

Now, consider Walmart. With a still-massive audience of around 100-120 million unique monthly visitors, it’s a major e-commerce destination. However, the number of active sellers on the platform is only between 150,000 and 200,000.

What this means for you is simple math. On Walmart, you are competing with a fraction of the sellers for a substantial pool of customers. Your share of voice is inherently higher. There is more digital shelf space available, making it easier for new and established brands to rank on the first page, build momentum, and capture market share without getting drowned out by a sea of competitors. It’s the classic “big fish in a smaller pond” scenario, and right now, the pond is growing fast.

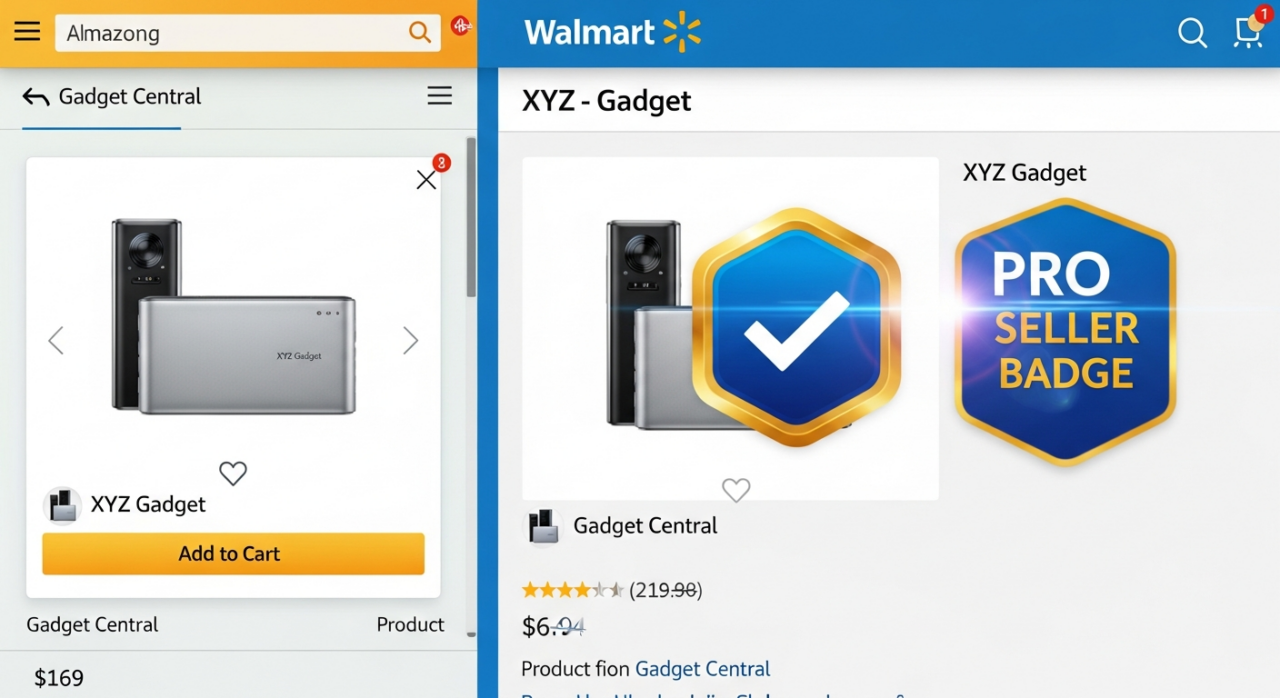

3. Gaining Recognition: The Power of the Pro Seller Badge

Trust is a non-negotiable currency in e-commerce. How does a platform help great sellers stand out and signal their quality to customers? Here, Walmart has developed a powerful and straightforward tool that Amazon lacks: the Pro Seller Badge.

This badge is awarded to top-performing sellers who consistently meet high standards for on-time delivery, customer satisfaction, and listing quality. It appears directly on your product listings and next to your seller name, acting as an immediate visual cue of trust and reliability for shoppers. The benefits are tangible: increased visibility in search, enhanced customer confidence, and ultimately, higher conversion rates. Pro Sellers also gain access to other perks, including special capital terms and faster payouts.

Amazon’s system is different. It focuses on product-specific badges like “Best Seller” or “Amazon’s Choice.” While valuable, these badges are tied to a single ASIN’s performance and don’t reflect the overall quality of you as a seller. There is no equivalent account-wide, publicly-facing badge that tells a customer, “This is one of the best sellers on the entire platform.” Walmart’s Pro Seller Badge rewards holistic excellence, helping you build a reputable brand across your entire catalog.

Is It Time to Make the Move?

The data is clear. Amazon remains the largest marketplace, but Walmart is offering a smarter, more strategic playing field. With a lower-cost fee structure, dramatically less competition, and a unique system for rewarding top sellers, it presents a powerful opportunity for growth and diversification. For sellers feeling the squeeze of rising fees and hyper-competition on Amazon, the question is no longer if you should consider Walmart, but how quickly you can get started with the right services.

Making the leap to a new marketplace can be daunting. If you need expert guidance to navigate the transition and optimize your strategy, reach out to our team today.

Need Help Growing Your Sales?

We are here to help you scale.